Table of Content

- Home Owners' Loan Corporation Law and Legal Definition

- Statement by the President on the Record of the Home Owners' Loan Corporation

- What brought about Home Owner Loan Corporation?

- What was bad about the Home Owners Loan Corporation?

- What was the goal or purpose of the Home Owner's Loan Corporation...

- how did the home owners loan corporation help

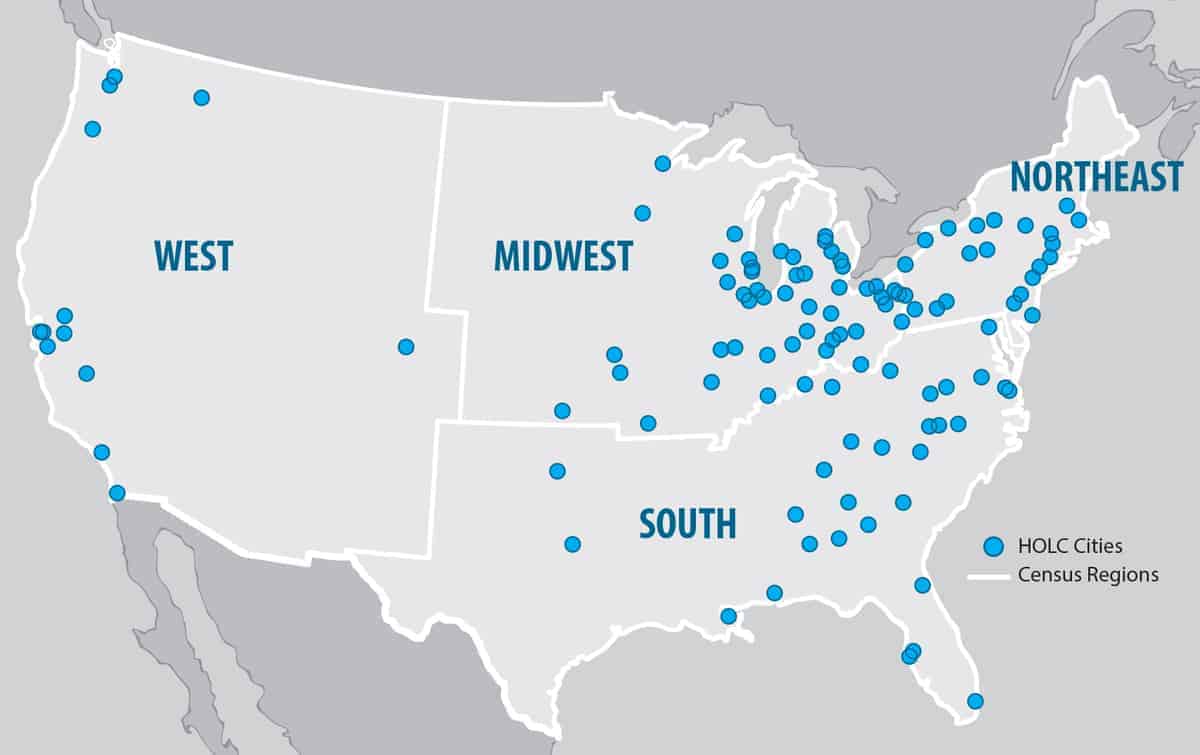

A study released in 2018 found that 74 percent of neighborhoods that HOLC graded as high-risk or "hazardous" are low-to-moderate income neighborhoods today, while 64 percent of the neighborhoods graded "hazardous" are minority neighborhoods today. “It’s as if some of these places have been trapped in the past, locking neighborhoods into concentrated poverty,” said Jason Richardson, director of research at the NCRC, a consumer advocacy group. There is significantly greater economic inequality in cities where more of the HOLC graded high-risk or “Hazardous” areas are currently minority neighborhoods. To a lesser extent this is also true of cities where more of the HOLC low-risk or “Desirable” areas have remained white. This could indicate that cities with less change in the racial and ethnic structure of their neighborhoods over the past 80 years have greater economic inequality today. The corporation was established in 1933 by the Home Owners’ Loan Corporation Act under the leadership of President Franklin D. Roosevelt.

Home Owners’ Loan Corporation; Provided mortgage assistance to homeowners or would-be homeowners by providing them money or refinancing mortgages. In the end, more than 800,000 homeowners repaid the HOLC credit, but a majority were able to repay them before the due date. This is in contrast to interest-only loans during the 1920s when the borrower made payments of the same amount as the amount of interest every month until the expiration of the loan, and then pay the principle at the conclusion the term of loan. Before the 1930s, loan the borrower would usually pay the principal due by borrowing new loans.

Home Owners' Loan Corporation Law and Legal Definition

HOLC was established as an emergency agency under Federal Home Loan Bank Board supervision by the Home Owners’ Loan Act of 1933, June 13, 1933. Foreign Exchange Regulation Act to regulate certain payments dealing in foreign exchange, securities, import & export of currency. National Industry Recovery Act It set up the National Recovery Adminstration and set prices, wages, work hours, and production for each industry. The Great Depression and Credit During the Great Depression of the 1930s, thousands of banks folded, robbing millions of Americans of their savings. Savings in banks were never insured, and as more people and businesses tried to withdraw their funds, the banking crisis intensified. As long as all parties knew the seller was becoming a cosigner and was being removed from the deed, and the lender would lend the money under these conditions.

Additionally, most of the HOLC graded “Hazardous” areas (nearly 64%) are minority neighborhoods now. In 3 years the HOLC refunded the overdue mortgages of more than 1 million families with long-term loans at lower interest rates. FHA loans—mortgages insured by the Federal Housing Administration and issued by an FHA-approved lender—are still in existence today. Designed for low-to-moderate-income borrowers, they require a lower minimum down payment and lower credit scores than many conventional mortgages. The HOLC tried to prevent selling too many houses in a short time in order to prevent negative impacts on the housing market. Overall, over 800,000 people paid back the HOLC loan, while a majority paid them off early enough.

Statement by the President on the Record of the Home Owners' Loan Corporation

The HOLC was attempting to keep from selling too many homes too quickly in order to prevent negative impacts on prices of housing. This is also in contrast to loans offered by Building and Loans (B&L) in the 1920s, which typically ran between 10 and 12 years. HOLC is often cited as the originator of mortgage redlining, although, this claim has also been disputed.

This emergency federal agency provided mortgage assistance to homeowners by lending low-interest money, refinancing mortgages, and originating new mortgages. HOLC issued government insured bonds to local lenders in exchange for delinquent mortgages in their portfolios. One of the lesser-known programs of President Franklin Delano Roosevelt's New Deal, the Home Owners Loan Corporation was established in 1933 to help struggling homeowners pay their mortgages. In cities and towns nationwide, the HOLC used government bonds to buy out mortgages from banks and then worked with borrowers to refinance them ... The standard HOLC loan prior to 1940, was an amortized 15 year loan, in contrast to the 3-year mortgages that were that commercial banks offered and the loans of years that were offered from Building and Loans in the 1920s. The interest rate for first HOLC loan was five percent at the time when mortgage loans were offered with an interest rate between 6 and 8 percent.

What brought about Home Owner Loan Corporation?

Instead, the agency purchased and refinanced mortgages in default or foreclosure from financial institutions . In exchange for mortgages, the HOLC gave lenders government bonds paying 4 percent interest . Treasury, the HOLC was authorized to issue $2 billion in bonds, an amount eventually increased to $4.75 billion. During a peak period in the spring of 1934, it processed over 35,000 loan applications per week and employed almost 21,000 people in 458 offices throughout the country. The law authorizing the HOLC's lending activities expired on June 12, 1936.

That’s in helping hundreds of thousands of families to maintain themselves as self-reliant homeowners. From the first year till the last year HOLC existed, it functioned effectively. It didn’t just functioned sucessfully in terms of dollars and cents, in terms of human values. It was in the midst of these crises that the Home Owners Loan corporation was formed.

What was bad about the Home Owners Loan Corporation?

The HOLC shut down its operations April 30th of 1951 with “a slight profit,” contrary to the belief that taxpayer money will be lost in this business [88. The Home Owners Loan Act in 1933 turned out to be among the most popular policies to emerge in the initial 100 days in the New Deal. Here You got Some Questions Which people Ask Most of the time on Google. HOLC was only available to homes owned by nonfarm owners, valued not more than $25,000.

The loans were purchased to homeowners who were having difficulties paying the bills on the mortgage loan “through not their fault”. A majority of the lenders profited from selling their loans since the HOLC bought the loans offering bonds with a value equal to the principal due by the borrower. The loan’s value represented the value of the loan which was refinanced to the borrower. The borrower benefited because they received a loan with an extended time frame and an interest rate that was lower. The lowest rated neighborhoods—those with high concentrations of racial minorities—were "redlined" by the HOLC, a term denoting an area considered too risky for government mortgage assistance. Redlining was adopted not only by private lenders, but also by public agencies, most notably the Federal Housing Administration , which was part of the National Housing Act of 1934.

HOLC ended its operations officially in the year 1951, when its assets were transferred for private lending. Direct reduction loans have been the most frequent kind in American mortgage. Moreso, it helped financial institutions pay off their depositors or investors as necessary and to remain in business. It also saved the local governments from the disastrous effects of widespread unemployment and loss of income.

Some scholars have argued that the maps and codification of appraisal practices introduced by the HOLC bolstered “redlining” as a pattern in government mortgage lending (Jackson 1987; Massey and Denton 1993). From this evidence it appears that the residential security maps were not used by the HOLC to qualify mortgage refinancing; however, it is unclear to what degree the maps may have been used later, by FHA appraisers. Greer’s 2014 analysis extends beyond the HOLC maps themselves to encompass later FHA mortgage risk maps of Chicago, finding that those maps directly impacted lending decisions, barring loans over larger sectors of the city.

These maps document how loan officers, appraisers and real estate professionals evaluated mortgage lending risk during the era immediately before the surge of suburbanization in the 1950’s. Neighborhoods considered high risk or “Hazardous” were often “redlined” by lending institutions, denying them access to capital investment which could improve the housing and economic opportunity of residents. Between 1933 and 1935, the HOLC made slightly more than one million loans. At that point it stopped making new loans and then focused on the repayments of the loans. The typical borrower whose loan was refinanced by the HOLC was more than 2 years behind on payments of the loan and more than 2 years behind on making tax payments on the property. The HOLC eventually foreclosed on 20 percent of the loans that it refinanced.

The Home Owners' Loan Corporation created by the Roosevelt administration was initiated to prevent home foreclosure in the United States. Though the actual agency was not liable for "redlining" it did provide regulatory structure for racial bias in the private mortgage industry. A common definition of redlining states that it is the practice of denying or limiting financial services in certain neighborhoods based on racial or ethnic composition without regard to applicants’ creditworthiness. It refers to the red line used to mark communities where financial institutions were not likely to invest. Ultimately, more than 800,000 people repaid their HOLC loans, and many repaid them early enough.HOLC officially ceased operations in 1951, when its last assets were sold to private lenders. The HOLC issued bonds and used the bonds to acquire loan mortgages from lending institutions.

how did the home owners loan corporation help

As intended, the main beneficiaries were homeowners at the lower end of the middle class with incomes in the $50 to $150 monthly range, persons who in the private market would have lost their homes. The Home Owners’ Loan Corporation was a federal program established in 1933 to provide relief to troubled mortgage borrowers and their lenders. The Home Owners’ Loan Corporation operated by purchasing mortgages from private lenders and issuing new mortgages to the borrowers.

It is now expected that when the HOLC is fully liquidated, the Treasury will have been repaid its capital advance in full, plus a surplus of several million dollars. It was formed to improve home ownership by insuring loans so lenders can offer lower down payments, lower closing costs, and make credit qualifying easier. Home Owners' Loan Corporation HOLC. Helped home-owners and mortgage companies. Government payed companies for the home-owners so they could keep their homes and pay off w/ lower interest and longer time. 1935 Created for both industrial recovery and for unemployment relief. During the late 1930s, the Home Owners' Loan Corporation developed a series of area descriptions with color-coded maps of cities that summarized mortgage lending risk.

No comments:

Post a Comment