Table of Content

- Operations Of Home Owners’ Loan Corporation

- How did the Federal Housing Administration help the Great Depression?

- Is there greater inequality in HOLC?

- Does the FHA still exist today?

- What did the Home Owners Loan Corporation do?

- HOLC “redlining” maps: The persistent structure of segregation and economic inequality

HOLC also assisted mortgage lenders by refinancing problematic loans and increasing the institutions liquidity. Within three years, In the span of three years, the HOLC reimbursed mortgages with outstanding payments of over 1 million families that had loans for long-term duration with lower rates of interest. The loans, which were subsequent advances, totaled approximately $3 billion. The families whose homes were saved were encouraged to hold on to their properties and repay their loans.

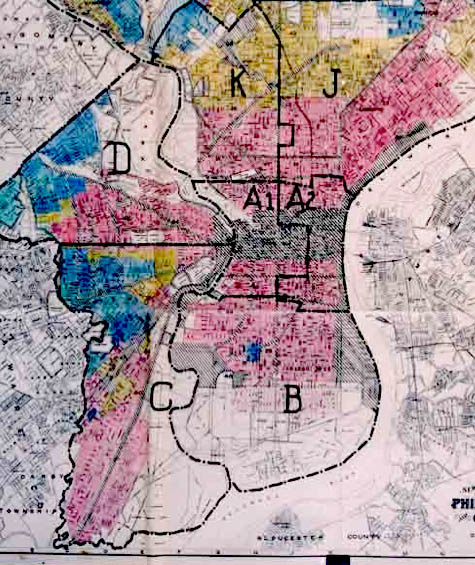

These maps document how loan officers, appraisers and real estate professionals evaluated mortgage lending risk during the era immediately before the surge of suburbanization in the 1950’s. Neighborhoods considered high risk or “Hazardous” were often “redlined” by lending institutions, denying them access to capital investment which could improve the housing and economic opportunity of residents. Between 1933 and 1935, the HOLC made slightly more than one million loans. At that point it stopped making new loans and then focused on the repayments of the loans. The typical borrower whose loan was refinanced by the HOLC was more than 2 years behind on payments of the loan and more than 2 years behind on making tax payments on the property. The HOLC eventually foreclosed on 20 percent of the loans that it refinanced.

Operations Of Home Owners’ Loan Corporation

In 1939, the company lowered rates to 4 1/2 per cent for a wide range of the borrowers. The HOLC loans typically amortized which meant that they would have equal monthly payments each month for the loan. It offered money at 5 percent, provided insurance for its loans through the Federal Housing Authority and the Federal Savings and Loan Insurance Corporation, and allowed up to twenty-five years for repayment. Every loan situation was handled individually, including personal visits to prevent default.

Many of the lenders gained from selling the loans because the HOLC bought the loans by offering a value of bonds equal to the amount of principal owed by the borrower, plus unpaid interest on the loan, plus taxes that the lender paid on the property. This value of the loan was the amount of the loan that was refinanced for the borrower. The borrower gained because they were offered a loan with a longer time frame at a lower interest rate. Home loan Residential Security Maps were developed in the early 1930s by a New Deal (federally-sponsored) corporation established for the purpose of home refinance.

How did the Federal Housing Administration help the Great Depression?

The urban reformer Charles Abrams pointed out that, on average, the HOLC refinanced the mortgages it purchased for only 7 percent less than the previous, admittedly inflated, value of the property in question . The HOLC, for example, might refinance a $10,000 mortgage as if the initial amount loaned to the home owner had been $9,300, but that figure—$9,300—could still be significantly higher than the current deflated market value of the property. Under this arrangement, lenders only had to forego a small part of their capital, plus they received government-backed bonds in place of frozen mortgages. On the other hand, by propping up the face values of its refinanced mortgages, the HOLC compelled home owners to repay inflated 1920s mortgage loans with deflated 1930s wages.

The HOLC was established pursuant to theHome Owners' Loan Corporation Act. In June 1933, the Home Owners' Loan Act, following the president's lead, sailed through Congress. The law authorized $200 million to set up the Home Owners' Loan Corporation with authority to issue $2 billion in tax-exempt bonds. The money raised would enable the HOLC to rescue imperiled mortgages by offering financing up to 80 percent of assessed value, to a maximum of $14,000. There followed a rush to file applications in 1934 by those holding 40 percent of all mortgaged properties, of which half with lowest risk were accepted.

Is there greater inequality in HOLC?

A key reason for the majority's failure was the restrictive mortgage system. Usually, borrowers were required to make down payments averaging around 35 percent for loans lasting only five to ten years at interest of up to 8 percent. At the end of that brief loan period, mortgage holders had to hope they could refinance or else come up with the remaining cost of the property.

75th Anniversary of the Wagner-Steagall Housing Act of 1937 The Home Owner’s Loan Corporation was created in 1933 to provide mortgage relief to home owners at risk of losing their homes through foreclosure. The HOLC was established in June 1933 to help distressed families avert foreclosures by replacing mortgages that were in or near default with new ones that homeowners could afford. A 2020 study in the American Sociological Review found that HOLC led to substantial and persistent increases in racial residential segregation. A 2021 study in the American Economic Journal found that areas classified as high-risk on HOLC maps became increasingly segregated by race during the next 30–35 years, and suffered long-run declines in home ownership, house values, and credit scores. Furthermore, it offers institutions, loan associations and other real estate investors to exchange defaulted mortgages for $2 3/4 billion in cash and Government bonds.. Through earnings on its loans, it has paid its own administrative expenses, and offset the real estate losses which it had to meet.

What is the Home Owners Loan Corporation quizlet?

Far from "ironically" issuing a few loans to African-Americans in an "initial phase" and then becoming a major promoter of redlining, HOLC actually refinanced mortgage loans for African-Americans in near proportion to the share of African-American homeowners. The pattern of loans had basically no relationship to the "redlining" maps because the program to create the maps did not even begin until after 90% of HOLC refinancing agreements had already been concluded. As for private lenders, though Kenneth T. Jackson's claim that they relied on the HOLC's maps to implement their own discriminatory practices has been widely repeated, the evidence is weak that private lenders even had access to the maps. By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers.

This shaky system was unable to withstand the shock of the 1929 economic collapse. The number of mortgages issued nationwide dropped from 5,778 in 1928 to a mere 864 in 1933, and many banks went under, dragging homeowners down with them. Or it could follow the lead of Herbert Hoover, who in 1932 had created the Federal Home Loan Bank to provide federal funding for lenders in the private housing market. Franklin Roosevelt, when he succeeded Hoover as president, inclined toward the latter course, but with government oversight and a focus on hard-pressed homeowners, rather than on the institutions controlling their mortgages. The home owners’ loan corporation was a fed. eral program established in 1933 to provide relief to distressed residential mortgage. Borrowers and their lenders, and is an important antecedent for current and future.

HOLC was officially shut down in 1951, after its last assets were transferred in 1951 to lenders from the private sector. These questions are approached through the spatial analysis of the HOLC map archive, and the degree to which the old grading corresponds with current neighborhood economic and racial/ethnic status. This is then compared with overall city-level indicators of segregation and economic inequality.

Consequently, the term of the loan could not change unless the loanee did not pay the loan. Due to the fact that HOLC obtains loans by providing a bond value equal to the amount of principal owing by the borrower, most of the lenders have benefited from the sale of their loans. This is because of the high-interest rate which if not paid at the right time, accumulates. Home Owner’s Loan Corporation was established to help manage this situation. Before the pandemic devastated minority communities, banks and government officials starved them of capital.

The HOLC was authorized to make loans from June 13, 1933 through June 12, 1936. The home owners' loan corporation was a fed. eral program established in 1933 to provide relief to distressed residential mortgage. Home Owner’s Loan Corporation also known as HOLC is a government owned body that aims at refinancing home mortages.

By that time, the HOLC had made 1,021,587 loans, making it the owner of approximately one-sixth of the urban home mortgage debt in the United States. The HOLC's operations were not officially terminated until February 3, 1954. Eighty years ago, a federal agency, the Home Owners’ Loan Corporation , created “Residential Security” maps of major American cities.

What did the Home Owners Loan Corporation do?

Home Owners’ Loan Corporation; Provided mortgage assistance to homeowners or would-be homeowners by providing them money or refinancing mortgages. In the end, more than 800,000 homeowners repaid the HOLC credit, but a majority were able to repay them before the due date. This is in contrast to interest-only loans during the 1920s when the borrower made payments of the same amount as the amount of interest every month until the expiration of the loan, and then pay the principle at the conclusion the term of loan. Before the 1930s, loan the borrower would usually pay the principal due by borrowing new loans.

The loans were purchased to homeowners who were having difficulties paying the bills on the mortgage loan “through not their fault”. A majority of the lenders profited from selling their loans since the HOLC bought the loans offering bonds with a value equal to the principal due by the borrower. The loan’s value represented the value of the loan which was refinanced to the borrower. The borrower benefited because they received a loan with an extended time frame and an interest rate that was lower. The lowest rated neighborhoods—those with high concentrations of racial minorities—were "redlined" by the HOLC, a term denoting an area considered too risky for government mortgage assistance. Redlining was adopted not only by private lenders, but also by public agencies, most notably the Federal Housing Administration , which was part of the National Housing Act of 1934.

No comments:

Post a Comment